Posts

Playing with investigation of number one supply, such as the Secretary away from Condition offices in most 50 says, Middesk helps their customers make certain enterprises trying to discover put account, pull out money or rating onboarded in order to costs rail while maintaining deceptive organizations aside. Even with competing with legacy databases such Dun & Bradstreet and you can Lexis-Nexis, it startup already have 600 customers, along with federal and you will local banks and company banking fintechs for example Mercury and you may Bluevine. From the 2008, on line banking is actually offered to house depositors and small enterprises.

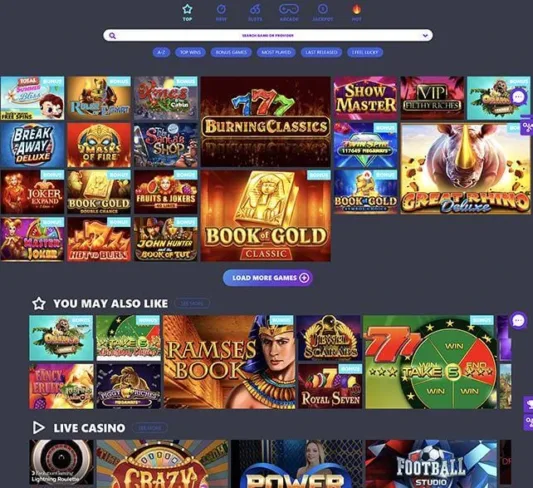

Brief vendors often, Atlantic casino reviews play online undoubtedly, bore off regarding the regulatory analysis submitted by the four banks to choose the label of the lender on the research, very government government and you may Congress have to flow this dilemma instantly to the top of their financial crisis priority listing. Mentormoney.com), the leading on the internet economic markets where you could buy financing and you may handmade cards. Zack ‘s the bestselling author of the newest blockbuster publication, The newest LEMONADE Life. Fruit titled The new Lemonade Lifetime one of “Fall’s Greatest Mp3 audiobooks” and a great “Must-Tune in.” The brand new Lemonade Life debuted since the #step 1 new business guide for the Fruit top seller chart.

The strong fundraising model says to founders just how much their bet was diluted within the state-of-the-art very early-stage rounds, and you will an offer letter tool automatically status the newest limit table when a different personnel welcomes. Last year, Pulley first started tracking token distributions to have Web3 and you can blockchain firms. Such, Earliest Republic, which was caught and you will ended up selling so you can JPMorgan Chase just after in initial deposit work on, offered the people jumbo mortgage loans in the lower rates, that was a “crazy proposal,” he said. Elder bank financing officials advised the fresh Provided recently in the an excellent every quarter questionnaire that they predict they will tense standards to your the newest financing all year. Founded inside the 1985, First Republic is the 14th largest You bank by possessions, having 212 billion after 2022.

Aguirre, an SEC base soldier, is attempting in order to interviews a major Wall Street executive — maybe not handcuff the guy otherwise impound their yacht, mind you, simply communicate with your. Mack himself, at the same time, was being illustrated from the Gary Lynch, a former SEC manager away from enforcement. More than beverages in the a club on the a good dreary, cold night inside Arizona the 2009 month, a former Senate investigator laughed when he polished of his beer.

The newest con scheme at issue went semi-viral the 2009 month, both underneath the hashtag “#fidelityboyz.” In one blog post that has more 4,five-hundred likes on the Instagram, numerous guys putting on Fidelity T-shirts have emerged throwing considerable amounts of money in the air. Citi, as an example, informed the new retailer they prices banks has between 500 billion and you can 700 billion in excess, non-interest-using dumps. Lender places usually increase every year, nevertheless the surge inside the deposits away from enterprises and consumers the exact same you to provides inundated financial institutions while the COVID-19 pandemic began try making it problematic for this year’s full in order to outpace 2021’s.

However, recently it already been to shop for right up junk-bond Replace Replaced Finance (ETFs) and you will said it can in the near future begin making outright purchases out of both money levels and rubbish-rated business bonds. That is why, the fresh demand for very-named safe assets powered the fresh 100 percent free circulate from financing on the property in the us. Which considerably worse the newest drama since the financial institutions and other financial institutions had been incentivized to topic more mortgage loans than ever before. Business debt exchange program you to works highest deals out of financing-degree, high-give, upset and you may emerging field securities for profiles in the 815 financial institutions.

Atlantic casino reviews play online – Yearly fee produce

“Increasing investment up against deposits and/or flipping out deposits is actually abnormal tips to have financial institutions and should not be good on the program eventually,” Jennifer Piepszak, JPMorgan Chase’s co-Chief executive officer out of user and you can people banking, informed traders this past year. Our very own goal during the Hide is to find visitors to start using — actually, we’re probably the only financial coach available to choose from who encourage the traders to provide all of us less cash first off. Adding a little bit every day most accumulates over the years, so we’lso are establishing wiser spending habits that may put the Stashers right up for very long name economic success. Like many mini-spending applications including Acorns and you will Robin Hood, New york city-dependent Hide cannot costs income for selecting otherwise offering inventory. There is an enrollment percentage from step 1 30 days accounts lower than 5,000, and you can 0.25percent a year to have stability more 5,one hundred thousand. 5 million is also generate ranging from 150,100000 so you can 250,one hundred thousand within the passive money within the relatively safe investments.

Dashboard Soars 53percent inside the Half a year: View Whether it’s Nonetheless essential-Get Inventory!

I assist show our very own traders and then make conclusion for themselves with advice and help from your Hide Coach. I have an information cardiovascular system entitled Discover and therefore sends Stashers enjoyable tips and you will blogs one to falter tricky topics such as diversity, holds vs. securities, material interest, and much more. We’lso are extremely proud of Understand and have got an extremely positive effect from our Stashers. “We invested in Stash as the we spotted it meeting a definite market you want very early for the,” said Chi-Hua Chien, controlling companion of Goodwater Investment, and this focuses primarily on early phase individual technical investment and you will co-provided (which have Valar Possibilities) Stash’s Show A good fundraising round.

The bank’s trajectory moved on quickly thirty days ago just after a great disastrous fourth-one-fourth declaration where it posted a shock losings, slash their dividend and astonished experts having its number of loan-losings conditions. MicroStrategy, after primarily a business software merchant, has been to purchase bitcoin because the August 2020. They ramped upwards acquisitions of your token this current year—especially after the Donald Trump’s November 5 election victory—as the people bet on a good crypto-friendly administration and you can Congress. Shares inside the MicroStrategy (MSTR), the biggest corporate manager of bitcoin (BTCUSD), sprang pre-market and then corrected direction to change lower Monday pursuing the the software team said they had ordered 5.cuatro billion of your cryptocurrency.

Fed’s action on the crisis

Who does features introduced the brand new outflow away from dumps while the avoid of one’s very first one-fourth from 2022 in order to a whopping 230.6 billion, and you may showing that bank lost deposits within the four of your own past six home. Nevertheless, Abouhossein said there is possibility of UBS in order to recover section of the newest nearly 500 billion inside the deposits and assets you to definitely left Borrowing from the bank Suisse more the very last 2 yrs. The new expert told you large deposit rates have been possibly used to help you restrict outflows from the Borrowing from the bank Suisse and had already been weigh for the bank’s capacity to strengthen cash.

If skill rises regarding the SEC or the Fairness Service, they ultimately jumps boat for these pounds NBA contracts. Or, on the other hand, students of your large business companies get sabbaticals from their rich lifestyles to help you slum it within the regulators services for per year otherwise a couple of. Those of us appointments is invariably hand-chose by lifelong stooges for Wall surface Street such as Chuck Schumer, who has accepted 14.six million inside campaign contributions out of Goldman Sachs, Morgan Stanley and other significant professionals from the financing community, making use of their corporate solicitors. While i ask a former federal prosecutor regarding the propriety out of a seated SEC movie director of enforcement speaking aloud in the enabling corporate defendants “get answers” concerning your condition of their violent times, the guy very first doesn’t accept is as true.

Get stock information, collection guidance, and on the Motley Fool’s superior services. But not, We suspect easily have always been wrong regarding the Fruit to be the first 5 trillion stock, it would be because the one of many most other brings I pointed out has reached the particular level at some point. In my opinion we’re going to see far more away from Fruit to your augmented facts front, as well — and not just having its Apple Eyes blended-facts headsets. As well as, 6G cordless systems will be offered by 2030, helping chill the brand new capabilities for example watching holographic pictures on your iPhones. Precisely the expectation of the you are going to force Apple over the 5 trillion market after that it decade.